"GLiddy" (GLiddy)

"GLiddy" (GLiddy)

10/15/2015 at 15:23 ē Filed to: None

3

3

27

27

"GLiddy" (GLiddy)

"GLiddy" (GLiddy)

10/15/2015 at 15:23 ē Filed to: None |  3 3

|  27 27 |

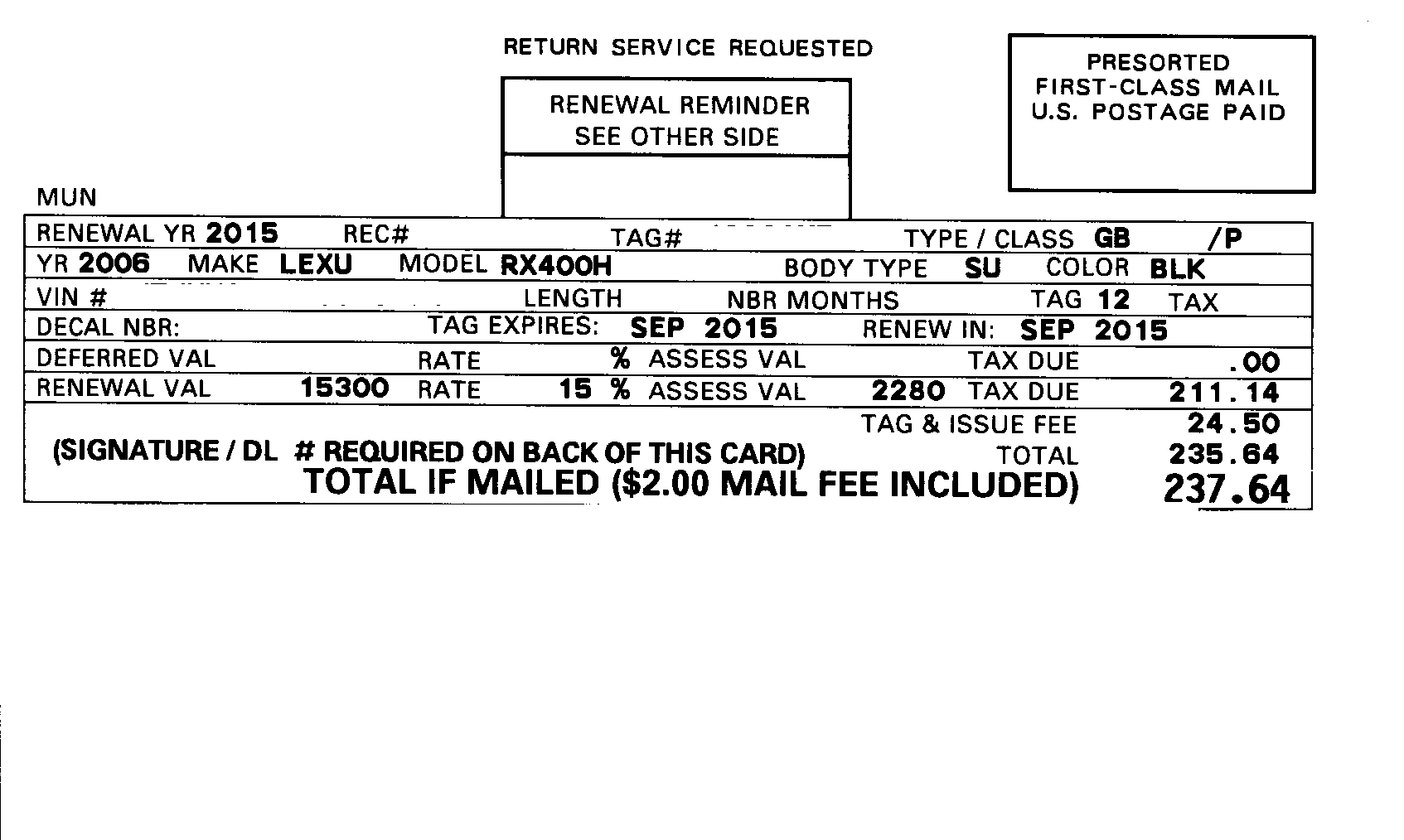

All these years Iíve never given a second thought to the amount of taxes I pay on my vehicles. Iíve always just looked at the assessed value on my registration document and seen that it is considerably less than the ďrealĒ value and figured Iím getting bargain. That is until I paid attention to a little card that my county assessorís office mailed me printed with the market value of my wifeís car.

$15,300 Is a ridiculously high value on a vehicle with 144,000 miles and parking lot damage. Now I will grant that the way the state assesses property for the year is by taking a value from October 1 of the previous year and applying that value starting January 1 of the next year. The value for all of 2015 is from October 1, 2014. (So they are already getting a bump in value that you are powerless to do anything about.)

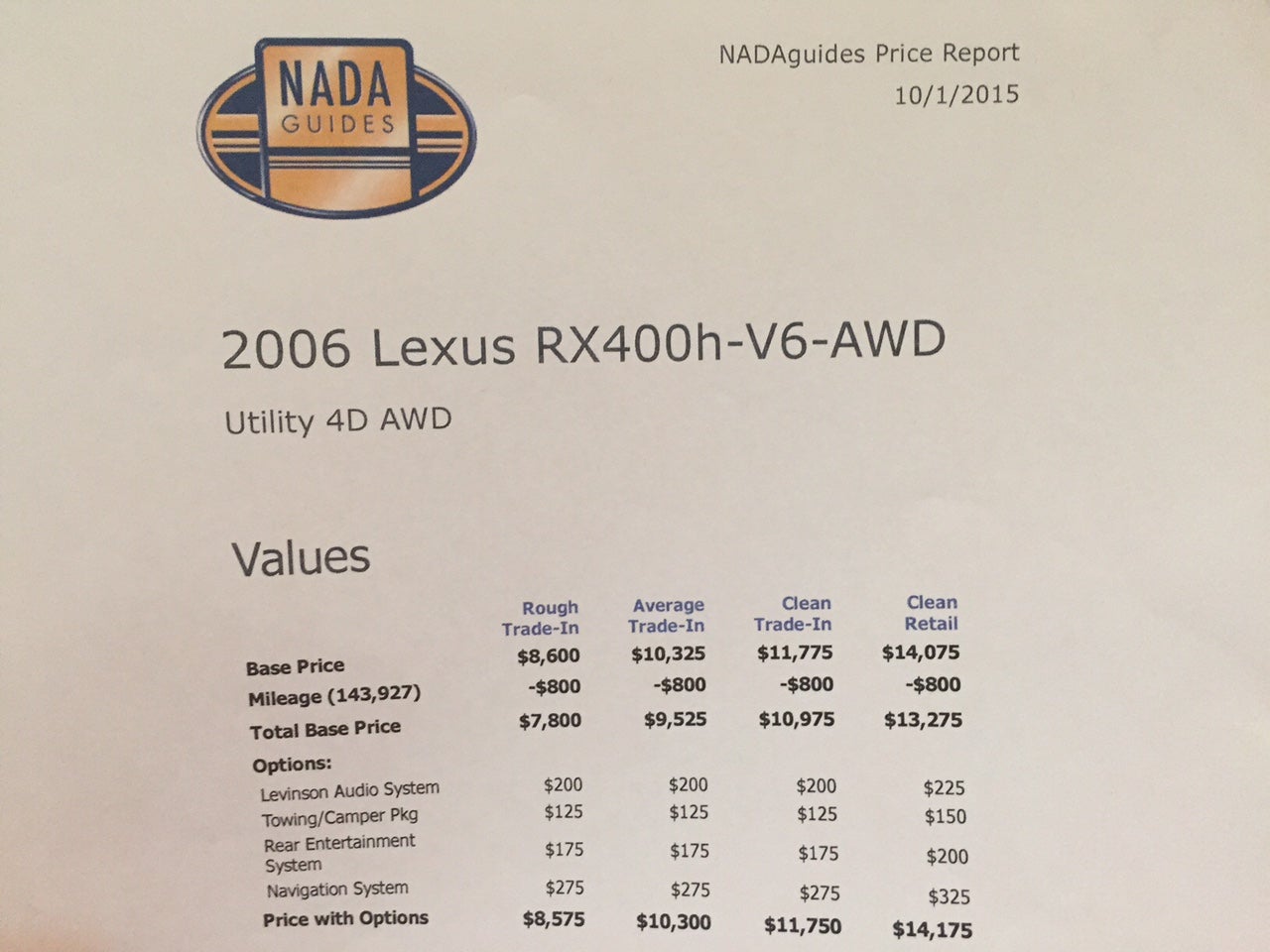

Still, I know this canít be a good value. Lets see what the online car valuations say: First NADA online guide done on the vehicle on October 1, 2015:

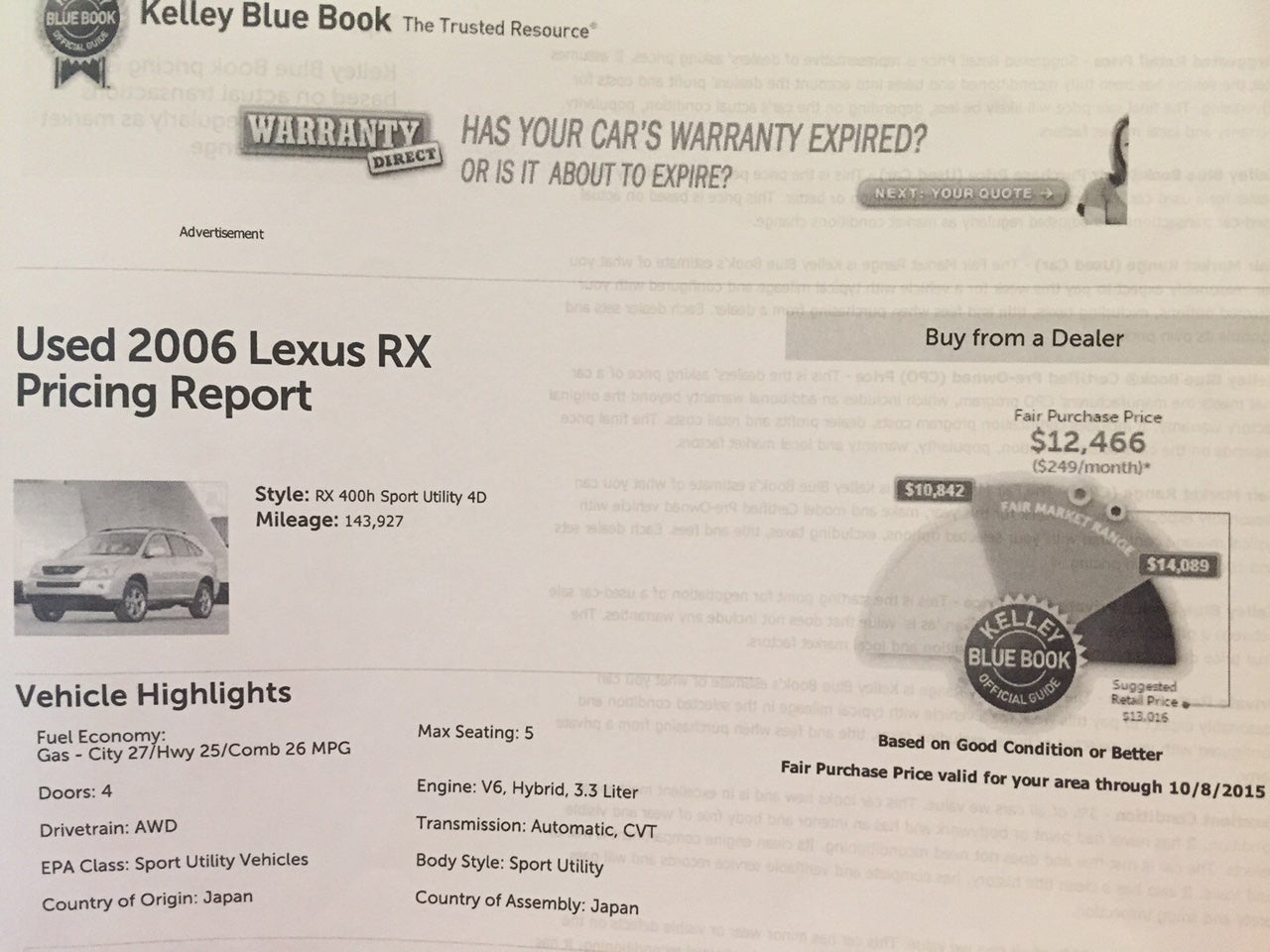

And KBB

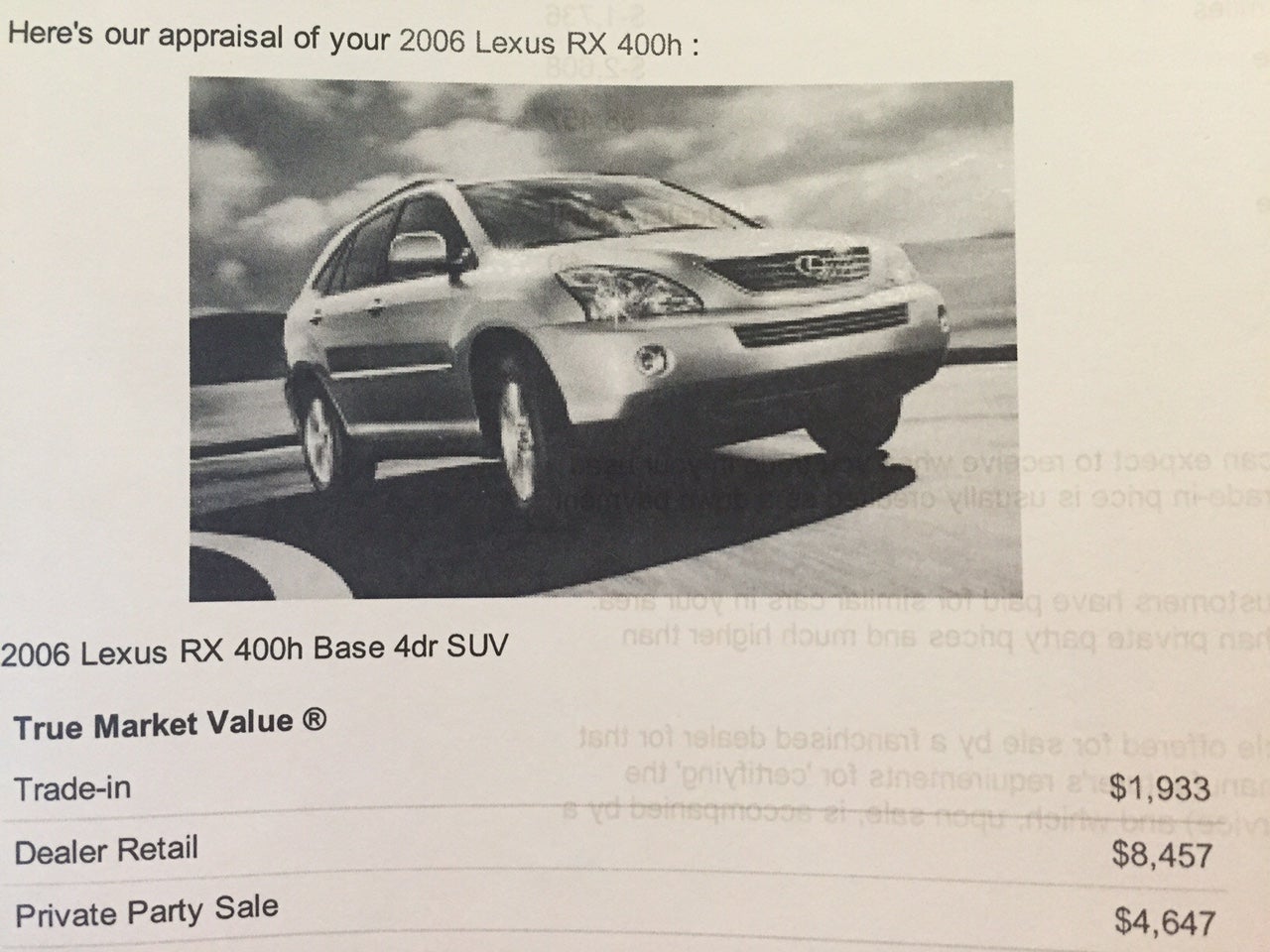

And finally Edmunds.com

Obviously Edmunds is low price. Retail is about half what the state says it should be.

Armed with these numbers, I contacted Edmunds.com to get a free historical price on the car for October 1, 2014. (I believe NADA and KBB will do this for a price...but free is better).

!!! UNKNOWN CONTENT TYPE !!!

Armed with this historical price ($10,069) I looked up the relevent regulations that the state uses to develop their vehicle values.

(2) PROCEDURES

To ensure the equitable taxation of motor vehicles ... the Property Tax Division ... shall determine the market value of vehicles using industry and other market sources having knowledge of average retail value by make, model, and type of motor vehicles. The market value shall be 89% of the determined retail value of the motor vehicle in order to account for pollution control equipment, depreciation, and the condition of the vehicle.

Given that I have a retail value of $10,069, I took 89% of that as stated in the regulations and used that as my opinion of value, which is $8961.41.

Now I can protest the value as it states in another part of the regulation.

(d) A valuation placed on a motor vehicle may be protested before the County Board of Equalization. The objection must be submitted in writing to the secretary of the Board not later than ten calendar days from the date taxes were paid.

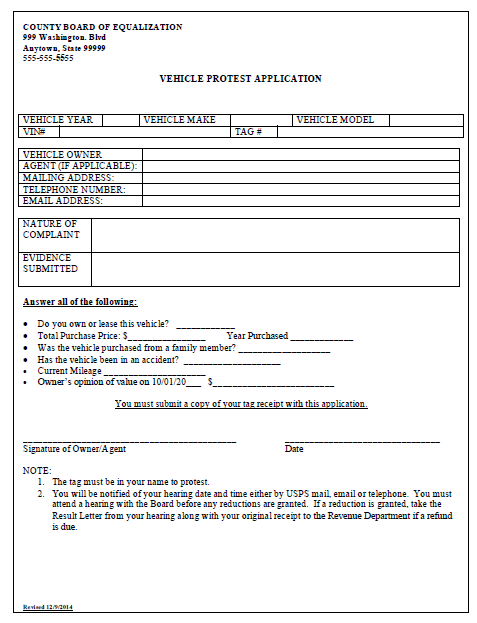

On the county website was a handy form that is used to protest valuations:

I filled out the form as indicated, and under the nature of complaint I put:

ďVehicleís assessed value is in excess of the retail value given condition and mileage. Vehicle has visible parking lot damage to front bumper, rear hatch and rear quarter.Ē

As my evidence I put:

ďCurrent retail appraisal from Edmunds.com ($8457). Historical retail appraisal on 10/1/14 ($10069). Ownerís opinion of value is 89% of 2014 value under 810-4-1-.18 Assessment Procedures. Photos of damage attached.Ē

I compiled copies of my Edmunds appraisals along with photos of the damage on my car and submitted it to the county board of equalization office as instructed.

Just now I received the following email:

Dear: Sir or Madam:

Year:2006 Make: LEXUS Model: RX400H

We wish to advise you that an oral hearing has been set for you to protest the renewal value of $15300 for the above listed vehicle. If someone will be representing you at your hearing that person must have written and assigned authorization. This includes spouses not listed as owner.

Your hearing has been set on 10/27/2015 at 10:00:00 AM

The following evidence will be needed at this hearing and you should come prepared to provide this evidence.

Information pertaining to the vehicle and the Bill-of-Sale.

The number of miles on the previous October 1.

Evidence of market value as of the previous October 1.

Sincerely,

Hopefully, I will be successful in my protest and Iíll be due some money back this year and pay less in subsequent years.

I suspect very few people bother to do this given the hassle of finding the documentation and proof needed and taking time to attend a hearing. I hope it will be worth my time.

Either way, expect an update around the end of the month.

GLiddy

> GLiddy

GLiddy

> GLiddy

10/15/2015 at 15:26 |

|

Apologies. Something happened with the formatting. Iíll try to fix it.

Ash78, voting early and often

> GLiddy

Ash78, voting early and often

> GLiddy

10/15/2015 at 15:31 |

|

I recently did this with my rental house and saved about $400 in property taxes. Since I had just renewed my HELOC, I had a recent appraisal in hand, which helped a lot. I had to schedule a hearing (really an interview) and the guy was super nice.

I never even thought about doing it with a newer car, but now that we have the wifeís 2015 and itís $600+/year, it might be worthwhile to point out all the dents and dings.

Also, is that registration form a national standard or do you happen to live in AL, too?

MontegoMan562 is a Capri RS Owner

> GLiddy

MontegoMan562 is a Capri RS Owner

> GLiddy

10/15/2015 at 15:34 |

|

Thatís called Kinja- donít worry too much, haha.

Interesting, let us know how it plays out.

duurtlang

> GLiddy

duurtlang

> GLiddy

10/15/2015 at 15:34 |

|

Thatís a lot of work for a discount of, what, $70?

Also, this seems like a rather inefficient/time-consuming(=expensive) way for the state to levy taxes. It is fairer and far cheaper than what I have to deal with though.

GLiddy

> duurtlang

GLiddy

> duurtlang

10/15/2015 at 15:40 |

|

You are quite likely right. Iím sure fleet operators would find this to be much more worthwhile. Iím doing this mainly for the experience and because my new occupation will put me in the courthouse fairly regularly. Might as well start finding my way around.

GLiddy

> Ash78, voting early and often

GLiddy

> Ash78, voting early and often

10/15/2015 at 15:44 |

|

Yeah, itís Alabama. I tried to strip out much of location specific stuff. Other localities probably have similiar procedures so I didnít want to make this too specific as to place.

This is not an issue for older cars. Alabama has a set valuation for cars older than 15 years, and thatís $500. I have a 2000 model van that is quite reasonable with respect to taxes given that.

HammerheadFistpunch

> duurtlang

HammerheadFistpunch

> duurtlang

10/15/2015 at 15:44 |

|

Thats what I was thinking too, also...I wonder out loud...what are the implications that this is related to an insurance payout if totaled? I mean, would the insurance adjuster go through the states records for values? or would they just do their own thing. My guess is their own thing, but you never know.

Svend

> GLiddy

Svend

> GLiddy

10/15/2015 at 15:46 |

|

Iíve said it before. As a person from across the pond this ďpaying state tax on a vehicles valueí each year and certainly paying a state tax on a private sale of a vehicle.

We have yearly emissions taxes based on CO2 output, vehicle type, etc... but we only pay the tax on the vehicle on itís first sale, along with itís registration which is the vehicles initial registration with the DVLA.

Paying a tax based on the value of the car each year doesnít help keep the roads safer with people almost trying to reduce the value of thier car to save on vehicle tax.

Ash78, voting early and often

> GLiddy

Ash78, voting early and often

> GLiddy

10/15/2015 at 15:49 |

|

Yep, my previous car was $31/year for several years, and now my current car is there, too :D

Glad to know this works, since the wifeís new Odyssey (less than a year) is already worth well below their alleged market value. Call it ďthe break-in periodĒ :D

Great writeup, good work. Now I wish I hadnít just paid them both...

shop-teacher

> GLiddy

shop-teacher

> GLiddy

10/15/2015 at 15:51 |

|

Thereís not much to like about Illinois, but a flat vehicle registration fee of $101 seems like a bargain now.

I protested the assessed value of our house a few years ago, and cut our property taxes by $3000 a year. I put it off until the last day I could do it, as I was dreading going to the county office and fighting the bureaucracy. I ended up being in and out in nine minutes!

BrianGriffin thinks ďreliableĒ is just a state of mind

> GLiddy

BrianGriffin thinks ďreliableĒ is just a state of mind

> GLiddy

10/15/2015 at 15:52 |

|

I'm really happy it's a flat $36 in PA.

GLiddy

> HammerheadFistpunch

GLiddy

> HammerheadFistpunch

10/15/2015 at 15:52 |

|

Iím sure they are like the state. They have a book they pull values out of. You may have a right to challenge depending on the wording of the policy. There is a thing called a ďpublic insurance adjusterĒ who is licensed by your state whom you can hire if you suffer a loss to deal with your insurance agency whose job is to maximize your payout. I donít even know if they will fool with auto claims.

GLiddy

> Ash78, voting early and often

GLiddy

> Ash78, voting early and often

10/15/2015 at 15:55 |

|

You have 30 days following the renewal of your tag to file your protest. If you plan on doing this next year, get your online appraisals now. (Its still close to Oct 1). Also be ready to document your mileage, as in go get an oil change/service/appraisal at Carmax to verify milage. Then next year when tag renewals roll around, submit your paperwork.

GLiddy

> Svend

GLiddy

> Svend

10/15/2015 at 16:05 |

|

Much of our property taxes go toward funding the public school system. In the past in my state, there have been problems with people who own vacation houses in rural areas buying their vehicle registrations in those counties (which have much lower taxes).

Schools would actually put people in the carpool lines to take note of car registrations in an attempt to catch people avoiding local school tax on vehicles.

GLiddy

> shop-teacher

GLiddy

> shop-teacher

10/15/2015 at 16:09 |

|

Its really not that bad. Iíve successfully protested a real estate valuation myself. These folks are government workers and this is their job. Its not like you are taking money out of their pockets.

You donít get extra points in the end for not taking advantage of things you are entitled to.

The worst that can happen in my case is that I get turned down. My tax cannot go up because they use a value in a book. In a real estate protest, you could conceivably end up paying more if they decide to reappraise your property.

jariten1781

> Svend

jariten1781

> Svend

10/15/2015 at 16:15 |

|

Not every state does it and the ones that do typically off-set by having lower taxes somewhere else (except the high tax burden states...NY, NJ, CT, CA, are the worst offenders). Determining total tax burden by state or individual in the US is a nightmare.

Also, itís not intended to be a behavior modification tax, itís a progressive revenue tax (same as any property tax based on value which also exist in varying degrees state to state).

Some places have it on all property for some people/companies...which is really obnoxious...ex. Fairfax County VAís Business personal property tax:

ďBusiness personal property is depreciated and taxed based on a percentage of original cost. Examples of business personal property include desks and chairs, computer hardware, specialized tools, machinery, and equipment.Ē

Yep...they tax chairs yearly. Chairs!

Svend

> GLiddy

Svend

> GLiddy

10/15/2015 at 16:15 |

|

We have a council tax based on the value of the home property at a certain period for this. The money is then divided up for council services (ie bin collection, police, fire service, etc...).

Cars, etc... pay a road tax/emission tax/vehicle excise duty for road maintenance (or sometimes lack thereof), maintaining transport infrastructure such as buses and trains.

AMGtech - now with more recalls!

> GLiddy

AMGtech - now with more recalls!

> GLiddy

10/15/2015 at 16:20 |

|

If the savings is large enough I canít help but wonder if it would be possible to start a business that does this for people. Probably not.

Svend

> jariten1781

Svend

> jariten1781

10/15/2015 at 16:21 |

|

Ouch. Thieving bast**ds.

This isnít the collector is it?

shop-teacher

> GLiddy

shop-teacher

> GLiddy

10/15/2015 at 16:22 |

|

We bought a short sale house in 2010 after the real estate market crashed. The appraised value may have been close to actual value at the peak, before the bubble burst, but it was nearly 40% higher than we had paid. Since we had an HUD1 (I think thatís the name of the form) with our actual sale price, they just accept that as the true value of the house.

GLiddy

> shop-teacher

GLiddy

> shop-teacher

10/15/2015 at 17:02 |

|

Iíd tend to agree that the market value is the sales price given that the buyer and the seller are not related.

shop-teacher

> GLiddy

shop-teacher

> GLiddy

10/15/2015 at 17:50 |

|

We werenít. I actually never met the seller, she didnít even come to the closing. The country agreed that the sale price was market value.

Tohru

> GLiddy

Tohru

> GLiddy

10/16/2015 at 00:33 |

|

Another reminder that Wisconsin is a good state to register a vehicle in. I have to pay tax on the purchase price of a vehicle just once - when itís initially registered under my name.

For an example, I paid $500 for my truck, and it takes Class B plates.

When I registered it, I owed the state $181:

- $69.50 title fee (this gets the vehicle in your name)

- $84 plate fee (this is to get a new set of Class B [6000lb. capacity] truck plates)

- $27.50 sales tax (5.5% of the $500 purchase price).

After this, I just have the regular yearly renewal of the plates - $84.

Having to pay taxes every year on your car is crazy.

tulips galore

> GLiddy

tulips galore

> GLiddy

12/06/2018 at 23:00 |

|

how did you make out on your protest? I agree, it's a lot of work, but well worth it, considering my pocketbook, and the fact that the voters in my state ,in their wisdom, voted† in the gas tax prop which includes the registration fees!!

GLiddy

> tulips galore

GLiddy

> tulips galore

12/06/2018 at 23:44 |

|

Itís been a few years now, and unfortunately the vehicle was a total loss due to an accident in 2017.† I did get the value adjusted in my favor and as I recall it saved me about $80 that year, and about the same the next year until it was ultimately wrecked.

franKENStin

> GLiddy

franKENStin

> GLiddy

07/09/2020 at 14:07 |

|

Did you ever get refunded some money for previous payment ? Or just the discount for prese nt and on ?

franKENStin

> GLiddy

franKENStin

> GLiddy

07/09/2020 at 14:14 |

|

Did you get a refund for previous year or just discount on present and on ?

Any idea if my 94 toyota truck wo uld be worth attempting this its 25 years old and I live in California .